This article is for information purposes only. I am in no way, shape, or form giving financial advice.

The best finance books are ones that bring value and encourage action—but those books can be hard to find. Did you know that over 4 million books are released per year and at least 500,000 of these books are published through traditional publishers? Knowing this, it can be difficult to find a book that’s genuinely useful for you.

After reading many of these and acquiring opinions from others within the financial field, I have gone ahead and decided to break down the best books that’ll help you make money, achieve financial freedom, and overall better your life.

So, in short, this guide will be discussing the following:

- Why this book was chosen

- Key takeaways from the book

- Charlie’s (aka the person writing this article) favorite section of the book

- Other readers’ opinions on the book

Best Finance Books for Wealth Building

- The Richest Man In Babylon by George Samuel Clason

- Think and Grow Rich by Napoleon Hill

- The Intelligent Investor by Benjamin Graham

- How To Get Rich by Felix Dennis

- The Millionaire Next Door by Thomas J. Stanley

Best Personal Finance Books

The Richest Man In Babylon

By George Samuel Clason

Why This Book Was Chosen

The Richest Man in Babylon was chosen #1 in this category for its timeless principles and practical advice on wealth accumulation and financial success.

It offers a framework that is still applicable today, almost a century after its publication, making it a valuable resource for anyone seeking to build wealth and take control of their financial future.

The book’s emphasis on saving, investing wisely, controlling expenses, and taking action resonates with individuals who have the “work smarter, not harder” mindset and are committed to achieving financial freedom.

Key Takeaways

- Save at least 10% of everything you earn and invest it wisely.

- Don’t spend more than necessary and control your expenditures.

- Compounding is super powerful for growing one’s wealth over time.

Charlie’s Favorite Section of the Book

My favorite section of ‘The Richest Man in Babylon’ is Chapter 6 – Increase Thy Ability to Earn.

In this chapter, Arkad shares invaluable insights on how one can improve their skills, work hard, and ensure a reliable income stream.

Through personal anecdotes backed by data-based evidence, Arkad emphasizes the importance of taking action promptly when it comes to finances.

I am someone who enjoys exploring different ways to find reliable income so reading this section was great.

Other Reader’s Opinions

One reader mentioned that he has carried what he learned from the book throughout his entire life, and this feedback comes from a 90-year-old.

Another reader mentioned that this book teaches you the basic principles of how to have more money.

The Total Money Makeover

By Dave Ramsey

Why This Book Was Chosen

The Total Money Makeover by Dave Ramsey was chosen because of its action-driven advice for achieving your financial desires.

With its step-by-step approach and real-life examples, this book provides valuable insights and motivation to take control of your finances and build a better future.

Key Takeaways

- Create a solid financial foundation by saving an emergency fund, paying off debt, and investing for the future.

- Reduce and eliminate debt to avoid future financial stress.

- Stick to a budget to control spending and track expenses

Charlie’s Favorite Section of the Book

The most impactful section of the book is where Dave Ramsey shares real-life examples and stories of individuals who have successfully followed the Total Money Makeover steps and achieved financial success.

These stories provide inspiration and demonstrate that financial independence is attainable with dedication and discipline.

It’s really encouraging to see how real people have overcome challenges and transformed their financial lives (from a perspective like mine).

Other Reader’s Opinions

The most insightful opinion I got was from an Amazon review regarding how this book is perfect for teenagers (this review interested me due to the fact that I am someone who was a teenager not too long ago).

Your Money or Your Life

By Joseph R. Dominguez and Vicki Robin

Why This Book Was Chosen

I chose Your Money or Your Life because it offers a fresh perspective on personal finance, challenging the conventional mindset and providing practical tools to transform our relationship with money.

It aligns with my belief in the power of conscious decision-making and intentional living.

In short, Your Money or Your Life is a must-read for anyone seeking financial freedom and a meaningful life.

Key Takeaways

- By identifying our “life values” expenses—the things that truly matter to us—and aligning our spending with them, we can experience greater fulfillment and financial freedom.

- Recognize the tendency to increase spending as income grows and actively resist it.

- Be mindful of how you spend your money and ensure it aligns with your values.

Charlie’s Favorite Section of the Book

My favorite section of the book Your Money or Your Life is Step 5: Identify your ‘lifestyle creep.’

In this section, the authors delve into the concept of how our spending tends to increase as our income grows—a phenomenon known as “lifestyle creep”.

They provide practical strategies to combat this tendency and maintain a conscious and intentional approach to our finances.

Also, the authors’ emphasis on aligning our spending with our values and questioning the societal pressure to constantly upgrade our lifestyles is truly eye-opening.

What’s cool is that they challenge the traditional notion of wealth, highlighting that true wealth lies in living a life that aligns with our values, rather than accumulating material possessions.

Other Reader’s Opinions

A reader from Amazon originally thought that this book was “basic” and “bland”, but soon realized that they were wrong.

Best Finance Books That’ll Change Your Money Mindset

Think and Grow Rich

By Napoleon Hill

Why This Book Was Chosen

Think and Grow Rich was chosen because it’s a timeless classic that offers invaluable wisdom and insights on personal development and success.

This book, written by Napoleon Hill, delves into the psychology of achievement, distilling the principles of success from interviews with over 500 accomplished individuals. It provides practical guidance on how to unlock your full potential and achieve your goals.

Whether you are just trying to be comfortable with your money, personal growth, or fulfillment in any area of your life, this book offers a ton of information that’ll help you on your financial journey.

Charlie’s Favorite Section of the Book

In my opinion, the most captivating section of Think and Grow Rich is the chapter on Desire.

Hill emphasizes that desire is the starting point of all achievement. He explains that what we desire and think about the most shapes our future.

I really enjoyed this section because it highlighted the power of our thoughts and the importance of aligning them with our goals.

Key Takeaways

- Our thoughts and desires shape our future, so it’s crucial to focus on what we truly want and visualize our desired outcomes.

- Nurturing faith and confidence in ourselves allows you to overcome obstacles and manifest your goals

- Persevering in the face of challenges and setbacks allows you to overcome any obstacle that’s thrown at you in life

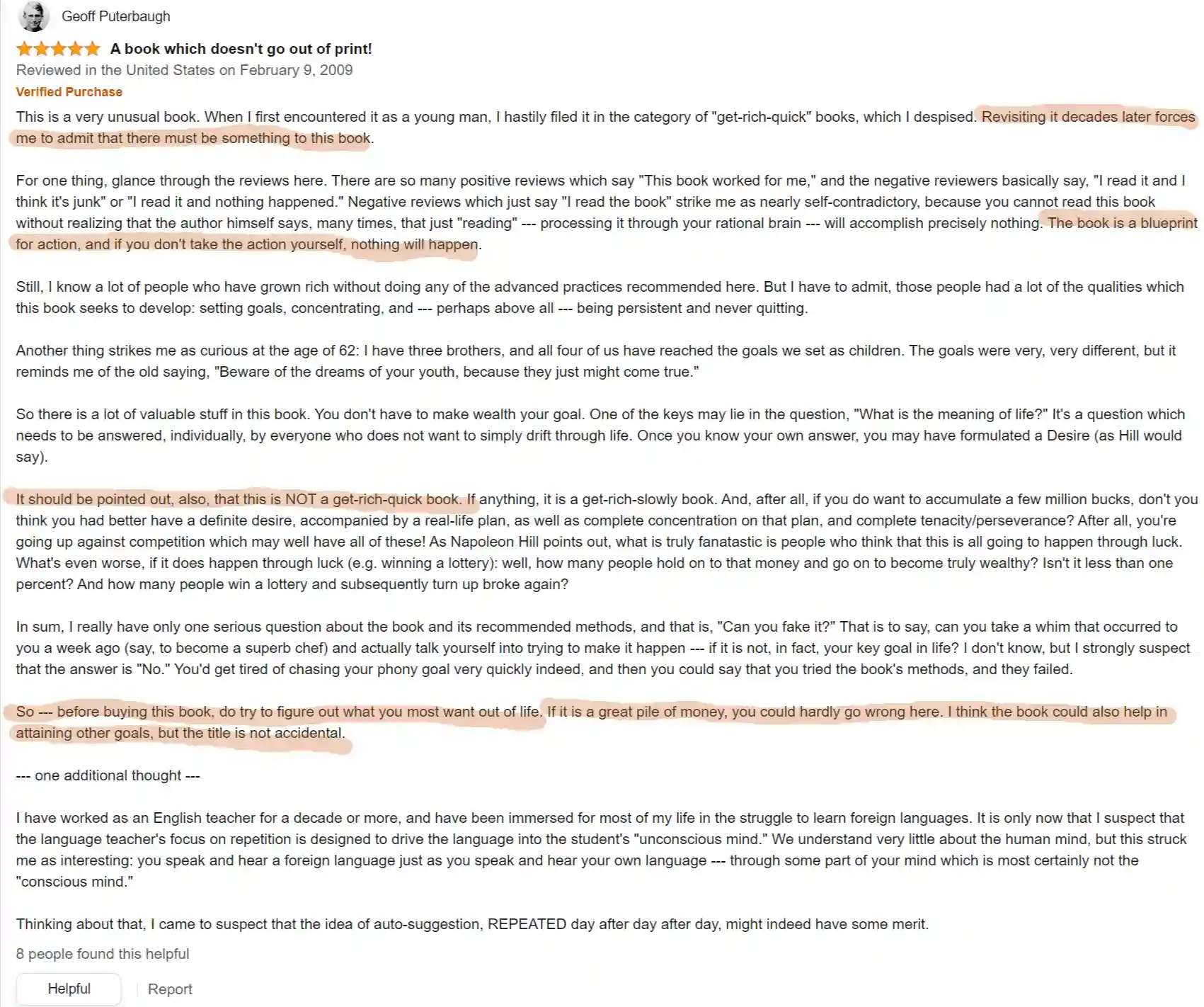

Other Reader’s Opinions

Like many books on this list, this one was released a long time ago (specifically in 1937).

This means that, although these books are old, people to this day are still learning valuable lessons that they can start applying right after finishing the book.

This reader specifically mentioned that this book is not a get-rich-quick scheme, but if you want to make a butt-load of money in the long run, you can’t go wrong here.

Rich Dad Poor Dad

By Robert Kiyosaki and Sharon Lechter

Why This Book Was Chosen

Rich Dad, Poor Dad was carefully selected due to its groundbreaking approach to personal finance and wealth creation. This book stands out in the genre for several reasons:

1. Mindset Shift: Kiyosaki challenges conventional beliefs about money and encourages readers to adopt a new mindset towards wealth.

2. Emphasis on Financial Literacy: The book stresses the importance of acquiring financial literacy and education.

3. Practical Strategies: It highlights the significance of investments and passive income streams, urging readers to build a portfolio of income-generating assets or businesses. The book also explores the potential benefits of real estate investing and the power of leveraging.

Also, I would like to clarify my stance on Rich Dad, Poor Dad being one of the greatest books of all time (due to the fact the word about it being the best has been going around the past few years).

Personally, I don’t believe Rich Dad, Poor Dad is the greatest book of all time, but I do believe it to be up there on that list.

Key Takeaways

- Challenges traditional beliefs about money, emphasizing that being rich is not solely determined by income but by how one manages and invests their money.

- Highlights the importance of understanding the basics of money management, investing, and building your money.

- Teaches readers the significance of making money work for them through investments and passive income streams.

Charlie’s Favorite Section of the Book

In my opinion, the most captivating section of Rich Dad, Poor Dad is Chapter 5 – The Rich Invent Money.

This chapter delves into the concept of financial intelligence and how developing this skill can significantly impact one’s profitability.

Kiyosaki shares his personal experiences and insights, providing realistic advice on increasing our financial IQ.

He also emphasizes the importance of being proactive in learning about money, investing, and personal finance.

Basically, where I am currently at in life, this section was helpful for me, especially when it came to Kiyosaki talking about the investing side of things.

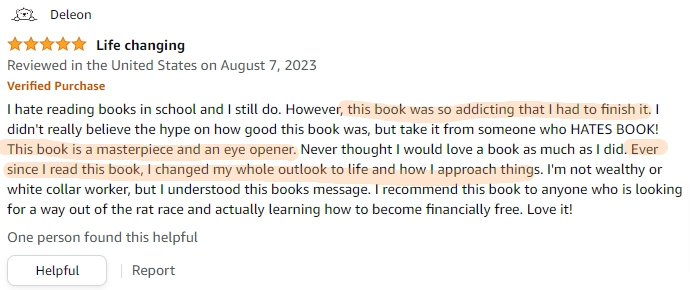

Other Reader’s Opinions

Don’t just listen to what I have to say on this one.

I’ll let other people who reviewed his book on Amazon speak for themselves, like this one reader who claimed that even though he hated reading books in school, this book changed his view.

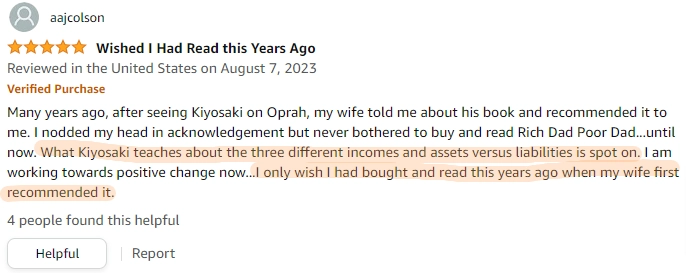

Another reader mentioned that they wish they read this book years ago.

The Simple Path to Wealth

By J.L. Collins

Why This Book Was Chosen

The Simple Path to Wealth stood out to me because it offers a refreshing and straightforward approach to achieving your financial dreams.

J.L. Collins combines his personal experiences with valuable insights, providing readers with a roadmap to financial freedom.

This book is a treasure trove of practical advice, guiding individuals on how to invest wisely, live below their means, and retire early.

With over 400,000 copies being sold and its emphasis on simplicity and real-life examples, this book is a must-read for anyone seeking to take control of their financial future.

Key Takeaways

- Investing in low-cost index funds is a powerful strategy for building long-term wealth.

- Living below your means and avoiding debt are essential for achieving financial independence.

- The 4% rule and calculating your retirement number are crucial steps in retirement planning.

Charlie’s Favorite Section of the Book

I would have to say that the chapter on Investing in Index Funds is my favorite.

This section delves into the power of low-cost index funds and how they can help you accumulate your wealth steadily over time.

J.L. Collins shows the advantages of index funds and offers guidance on how to invest in them effectively.

With his personal anecdotes and expertise, Collins simplifies the complex world of investing, making it accessible to readers of all backgrounds.

Other Reader’s Opinions

The most insightful opinion I got was from an Amazon review regarding how this book is perfect for teenagers (this review interested me due to the fact that I was a teenager not too long ago).

Best Finance Book for Investing

The Intelligent Investor

By Benjamin Graham

Why This Book Was Chosen

The Intelligent Investor is a book that I personally chose because of its timeless wisdom and real-world advice on value investing.

As someone who’s currently learning about investing and has made prior investments (with the help of my brothers), I understand the importance of long-term strategies and finding stocks that are undervalued.

Benjamin Graham, a renowned investor and finance professor, provides valuable insights that are still relevant today.

This book is perfect for individuals who are looking to get richer through intelligent investing.

Graham’s emphasis on long-term thinking and avoiding market timing aligns with my own investment philosophy.

By focusing on intrinsic value and buying stocks at a discount, readers can develop a solid investment portfolio.

Charlie’s Favorite Section of the Book

The Investor and the Market section is undoubtedly my favorite part of The Intelligent Investor.

Graham introduces the concept of Mr. Market, which personifies the emotional swings of the stock market. This section provides super useful intel into understanding market behavior and how to navigate its ups and downs.

Graham’s analogy of Mr. Market as a business partner who offers to buy or sell stocks at different prices each day is both entertaining and enlightening. It serves as a reminder to investors to remain rational and not be swayed by market fluctuations.

Key Takeaways

- By avoiding short-term market timing, investors can benefit from the power of compounding over time.

- Value investing = buying stocks below their intrinsic value. This approach allows investors to identify opportunities and potentially maximize returns.

- The concept of buying stocks with a margin of safety is crucial because it provides a buffer against potential losses and increases the likelihood of achieving positive returns.

Other Reader’s Opinions

One reader mentioned that Grahm, who is a pioneer in value investing, emphasized the importance of investing with a margin of safety and avoiding speculation.

Another reader mentioned that throughout the book, Graham helps people ‘detach emotion from the market’.

A Random Walk Down Wall Street

By Burton Malkiel

Why This Book Was Chosen

A Random Walk Down Wall Street stood out among the vast sea of investment books for several reasons.

First and foremost, its timeless wisdom and evidence-based approach make it a must-read for anyone seeking prosperity.

Malkiel’s ability to simplify complex concepts and deliver them in a friendly and approachable tone is truly remarkable.

His expertise shines through as he debunks common investing myths and provides valuable insights based on rigorous research.

Moreover, In a world where the stock market can seem daunting and unpredictable, A Random Walk Down Wall Street offers a guiding light, empowering readers to make informed investment decisions and navigate the financial landscape with confidence.

Key Takeaways

- Embrace the power of low-cost index funds that track market indices, providing a reliable and historically successful investment approach.

- Focus on long-term investing for sustainable success instead of trying to time the market and short-term success.

- Spread your investments across a variety of assets to reduce risk and improve returns. Don’t put all your eggs in one basket.

Charlie’s Favorite Section of the Book

As I delved into the pages of A Random Walk Down Wall Street, one section that truly captivated me was the chapter on the importance of index funds. It opened my eyes to a low-cost and reliable way to invest in the stock market.

In this chapter, Malkiel emphasizes the power of index funds in tracking specific market indices, such as the renowned S&P 500.

He highlights how these funds have historically outperformed actively managed funds, debunking the myth that stock picking can consistently beat the market.

The simplicity and effectiveness of this strategy truly resonated with me, aligning with my interest in long-term investing.

Other Reader’s Opinions

This book is proclaimed by one reader as being for people looking for ‘smart investing strategies.’

Another reader mentioned that the book is overall full of informative information and simply explains why stock picking and different techniques do not work.

The Little Book of Common Sense Investing

By John C. Bogle

Why This Book Was Chosen

The Little Book of Common Sense Investing was chosen for its view on index investing, which aligns with the desire for innovation in the financial world.

This book offers a refreshing perspective that challenges traditional active management strategies and promotes a passive investment approach.

Bogle’s expertise, combined with his ability to communicate complex concepts in a clear and concise manner, makes this book a valuable resource for both beginners and experienced investors.

By following Bogle’s advice, readers can gain a deeper understanding of index investing and take the necessary steps toward building long-term wealth.

Reader’s Favorite Section of the Book

Although I have not read this book myself, I found that many readers across the web found that the best section of The Little Book of Common Sense Investing is Chapter 4: Invest for the Long Term.

Bogle’s insights on the long-term perspective of the stock market clearly resonated with the readers.

“He reminds us that although the market may be volatile in the short term, it has historically trended upwards in the long run,” says one reader.

Bogle’s advice to focus on the big picture and resist the urge to make impulsive decisions based on short-term fluctuations is invaluable.

Key Takeaways

- Index funds are the ideal way for most investors to build wealth over time. They offer low costs, tax efficiency, and simplicity, making them accessible even for those without financial expertise.

- Bogle encourages investors to adopt a long-term approach and stay committed to their investment plan.

- Spread your investments across different asset classes so you can protect yourself from the volatility of individual stocks.

Other Reader’s Opinions

“If you’ve got money to invest you really need to read this book,” says an enthusiastic reader.

Even more, accumulating wealth through investing is a prime focus and the reader goes more into that below.

The Wealthy Barber

By David Chilton

Why This Book Was Chosen

The Wealthy Barber was chosen because it provides an insightful guide to personal finance, offering clear and concise instructions on how to manage your money effectively.

This book stands out as it is based on sound financial principles, emphasizing financial literacy and sound financial planning as the foundation for wealth creation.

Moreover, The Wealthy Barber is written in an easy-to-understand style, making it accessible for beginners who are looking to gain a better understanding of personal finance.

Key Takeaways

- Start saving early—time is your greatest ally in growing your wealth.

- Live below your means—spending less than you earn is the key to financial stability and freedom.

- Diversify your investments—by spreading your investments across different assets, you can reduce risk and maximize potential returns.

Charlie’s Favorite Section of the Book

My favorite section of The Wealthy Barber was the chapter on “Start saving early.”

Chilton masterfully emphasizes the importance of time in growing your wealth. His storytelling skills truly shine as he vividly describes the journey of a young individual, realizing the power of compounding and the regret of not starting earlier.

This section provides a wake-up call for readers to take immediate action, utilizing the em dashes for emphasis and informal pauses, creating a sense of urgency and relatability.

Other Reader’s Opinions

One reader mentioned how this book is similar to The Richest Man in Babylon, but as if it was set more in the modern time.

The Automatic Millionaire

By David Bach

Why This Book Was Chosen

The Automatic Millionaire was chosen because of its actionable advice for anyone looking to improve their financial situation and build wealth.

What was intriguing to many readers was the idea of automating finances and the potential it holds for long-term financial success.

This book provides a clear roadmap for achieving financial goals by emphasizing the importance of automation, saving, and investing.

With its accessible writing style, it’s a perfect choice for both beginners and those looking to refine their financial strategies.

Key Takeaways

- By setting up automatic transfers to your savings and investment accounts, you make saving a habit and remove the temptation to spend money impulsively.

- Allocating a portion of your income towards your financial goals before paying bills or indulging in discretionary expenses ensures that you’re actively making money and not just relying on what’s left after expenses.

- Spreading your investments across different asset classes, such as stocks, bonds, and real estate, allows you to protect yourself from market fluctuations and increases your chances of long-term growth.

Reader’s Favorite Section of the Book

Many reader’s favorite section of The Automatic Millionaire seems to be The Pay Yourself First System.

This section resonates with the people who read the book because it emphasizes the importance of automating your finances and prioritizing saving and investing.

Bach’s concept of paying yourself first before spending on anything else is a game-changer. It’s a simple but powerful strategy that ensures money is coming in consistently.

Other Reader’s Opinions

I found one review on Amazon particularly funny due to the fact that it seemed like something I would totally write myself.

In short, this reviewer talked about how finance books were simply not exciting, but once they got into it, they couldn’t stop (which was the exact same situation as me).

The Four Pillars of Investing

By William J. Bernstein

Why This Book Was Chosen

The Four Pillars of Investing stood out due to its comprehensive approach to investing, covering all essential aspects from basic principles to advanced topics.

Moreover, this book’s foundation in sound financial principles and modern portfolio theory piqued my interest.

The easy-to-understand writing style, packed with useful advice for building a successful investment portfolio, was a major draw.

With this book being praised by financial experts worldwide, it’s evident that this book has stood the test of time and resonated with readers.

Key Takeaways

- Get a head start on investing and give your money more time to grow.

- While the stock market may be volatile in the short term, it tends to trend upwards in the long run.

- Spread your investments across different assets to reduce risk and increase potential returns.

Reader’s Favorite Section of the Book

Many readers’ favorite section of the book seems to be the section on the Psychology pillar.

Bernstein’s insights into the emotional biases that can affect investment decisions are quite interesting.

He emphasizes the importance of self-awareness and gives feasible advice on managing these biases, helping readers make more rational investment choices.

Other Reader’s Opinions

One reader of the book mentioned that it’s not a hard read and it ‘clearly explains why people who are always chasing higher returns typically get returns less than the market’s overall returns.’

The Bogleheads’ Guide to Investing

By Mel Lindauer, Michael LeBoeuf, and Taylor Larimore

Why This Book Was Chosen

The Bogleheads’ Guide to Investing was chosen because it is a comprehensive and accessible resource for anyone interested in index investing.

The book covers all the essential aspects of this investment strategy, from the fundamentals to more advanced topics, making it suitable for both beginners and experienced investors.

The authors’ emphasis on low-cost, passive investing aligns with my own investment philosophy.

Their clear and concise writing style makes complex concepts easy to understand, allowing readers to grasp the principles of index investing without feeling overwhelmed.

Moreover, the pragmatic advice provided in the book can help readers build a successful investment portfolio and avoid common pitfalls.

The authors’ understanding of the market and their commitment to empowering individuals with financial knowledge make this book a must-read for anyone seeking a new perspective in their investment approach.

Charlie’s Favorite Section of the Book

My favorite section of The Bogleheads’ Guide to Investing is Part 3: Advanced Topics.

This section delves into more complex aspects of index investing, such as asset allocation and tax-efficient strategies.

In Part 3, the authors shows the readers how to optimize their investment portfolio and navigate the challenges that may arise.

They emphasize the importance of diversification and explain how to allocate your assets effectively to minimize risk.

Additionally, they provide guidance on tax-efficient investing, helping readers understand how to maximize their returns while minimizing their tax liability.

The insights provided are invaluable for those who want to go beyond the basics of index investing and build a successful long-term investment strategy.

Key Takeaways

- Index investing is a low-cost and effective strategy for long-term wealth accumulation.

- Diversification across different asset classes is crucial to reduce risk.

- Tax-efficient investing can significantly impact investment returns.

Other Reader’s Opinions

One reader said that this book ‘got them thinking for the long term,’ as the reader didn’t know where to start when it came to retirement savings.

I Will Teach You to Be Rich

By Ramit Sethi

Why This Book Was Chosen

I Will Teach You to Be Rich is a solid book due to its actionable view on personal finance.

The book’s clear and concise instructions make it an ideal resource for individuals seeking financial innovation.

Ramit Sethi‘s expertise and relatable writing style captivate readers, making complex financial concepts accessible and engaging.

With its emphasis on long-term investing, automating finances, and setting clear goals, this book offers a ton of value to the everyday person.

Key Takeaways

- Set specific and realistic goals so you can create a roadmap to improve your financial goals.

- Take advantage of automation by setting up automatic transfers to your savings and investment accounts.

- Paying yourself first means allocating a portion of your income towards savings and investments before anything else.

Charlie’s Favorite Section of the Book

My favorite section of the book in I Will Teach You to Be Rich was Part 3: Invest for the Long Term.

This section provided insights on how to invest wisely and achieve long-term financial goals.

The author, Ramit Sethi, expertly explained the benefits of investing for the long term and how it can lead to significant growth in your wealth.

Sethi’s emphasis on not getting swayed by short-term market fluctuations and staying focused on the big picture (which is similar to many books in this article) was what got me interested.

Other Reader’s Opinions

One reader gave seven reasons on the type of people who should get this book and also mentioned how quality this book is.

The Psychology of Money

By Morgan Housel

Why This Book Was Chosen

The Psychology of Money was an obvious choice for me due to my desire for innovation and a deeper understanding of the psychological factors influencing our financial decisions.

As someone who values personal finance and continuous improvement, this book provided valuable insights that I could immediately apply to my own life.

Housel’s clear and concise writing style combined with his thought-provoking stories made for an engaging read.

Plus, the actionable advice he provided was a game-changer for my financial well-being.

Key Takeaways

- Don’t focus on short-term market fluctuations; instead, take a long-term perspective.

- Avoid trying to time the market, as consistently predicting its movements is impossible. Trust in the power of compound interest and let your money grow over time.

- Embrace the possibility of losing money. Mistakes happen, even in the investing world.

Charlie’s Favorite Section of the Book

In my opinion, the most captivating section of The Psychology of Money was Chapter 4: The Sunk Cost Fallacy.

This chapter shed light on a common behavioral bias that many of us fall victim to – the tendency to continue investing in something even when it’s clear that it’s not a good investment.

Housel’s insightful storytelling, combined with his expertise, effectively demonstrated the irrationality behind this phenomenon. (And let me tell you, it’s a tough one to overcome)

Other Reader’s Opinions

One reader mentioned that this book doesn’t only apply to finance, but also many other aspects of her life.

The Millionaire Fastlane

By M. J. DeMarco

Why This Book Was Chosen

The Millionaire Fastlane was chosen because it offers a fresh perspective on wealth creation, challenging the traditional approach and providing actionable strategies for long-term wealth.

This book speaks to those who want to go against the grain and are willing to take calculated risks to achieve their long-term financial goals.

M.J. DeMarco’s unique insights and storytelling approach make this a captivating read, inspiring readers to think outside the box and pursue unconventional paths to success.

In short, DeMarco wrote a great book and the everyday reader looking to gain some more intel on how to make money should read this.

Key Takeaways

- If you’re able to start a business, you can tap into unlimited income potential. This one is quite obvious though.

- Real estate is a great choice for passive income, especially through rental properties, which provide valuable guidance for those looking to diversify their investment portfolio.

- Keeping expenses in check and saving a significant portion of your income will allow you can create a solid foundation for understanding your financials.

Charlie’s Favorite Section of the Book

My favorite section of The Millionaire Fastlane is Part 2: The Fastlane.

This section discusses DeMarco’s alternative approach to wealth creation, which encourages readers to break free from the traditional mindset of working hard, saving money, and investing for the long term.

He highlights the potential for greater income and freedom that comes with entrepreneurship and real estate investments.

And, It’s really nice to see a book that challenges conventional thinking through unconventional means.

Other Reader’s Opinions

“You need to be the producer first and the consumer second,” said one reviewer in a positive manner.

The Compound Effect

By Darren Hardy

Why This Book Was Chosen

The Compound Effect was chosen because it offers practical advice for personal and professional development, written in a clear and concise style (which is right up my alley).

This book is pretty straightforward as Darren Hardy motivates and helps the reader believe in themself to achieve any goal the reader desires.

The author, Darren Hardy, has received praise from influential figures like Tony Robbins and Oprah Winfrey, and the book has sold over 1 million copies worldwide (so you know it’s gotta be worth your time).

Key Takeaways

- Start small and gradually build momentum with achievable goals.

- Consistency is key—make small, consistent changes that will add up to big results over time.

- Don’t give up, even when setbacks happen (because they will)—keep pushing forward and you’ll reach your goals.

Reader’s Favorite Section of the Book

Many readers’ favorite section of The Compound Effect was when Hardy talked about the power of small choices—those little decisions we make every day that seem insignificant but can have a massive impact.

This section really opens the reader’s eyes to how consistency plays a key role in achieving long-term success.

And let’s not forget about the importance of failing forward, because, hey, failure is a necessary part of the learning process (been there, done that).

Other Reader’s Opinions

A reader from Amazon’s opinion spoke loudly as the reader said that the book is for people looking to make a change in their lives right now.

Best Finance Books for Entrepreneurship

How To Get Rich

By Felix Dennis

Why This Book Was Chosen

How to Get Rich by Felix Dennis was chosen because it’s not just a regurgitation of generic advice, but a practical guide based on the personal experiences and insights of a self-made millionaire.

Dennis guides his readers with actionable strategies and a fresh perspective on how to think and act to become wealthy.

Charlie’s Favorite Section of the Book

My favorite section of How to Get Rich is the part where he emphasizes the importance of preparation.

Felix reminds us that luck is not something that magically falls into our laps; it’s the result of being prepared and seizing opportunities when they arise.

By doing the heavy lifting and homework in advance, we can identify and exploit these opportunities to propel ourselves towards our financial dreams.

Basically, what got me hooked on this section was the fact that it highlighted the value of hard work, foresight, and being ready to pounce on the right moment.

Key Takeaways

- Putting in the necessary groundwork and being prepared increases your chances of being in the right place at the right time.

- The journey to riches requires a willingness to fail, work long hours, and not care about others’ opinions. Treat it as a game, keeping a light-hearted approach.

- Don’t let failure hold you back; instead, use it as a motivator to take action and push past your comfort zone.

Other Reader’s Opinions

An enthusiastic reader from Amazon talked about how if someone truly wants to get rich, there’s nothing stopping them.

What the Most Successful People Do Before Breakfast

By Laura Vanderkam

Why This Book Was Chosen

What the Most Successful People Do Before Breakfast by Laura Vanderkam was chosen because it offers practical insights and guidance on how to optimize our mornings for productivity and success.

With a friendly and approachable tone, Vanderkam explores the power of morning hours and shares real-life experiences of successful individuals, providing valuable inspiration and actionable advice.

The book’s emphasis on personalization and the absence of a one-size-fits-all approach made a ton of sense to me, prompting me to start optimizing my own morning routine.

By incorporating the proven strategies and tailored morning practices from this book, you have the potential to transform mornings into a time of purpose, setting the stage for a successful day ahead.

Key Takeaways

- The morning hours are the most productive time of day–a chance to harness our energy and willpower.

- Successful people have diverse morning routines tailored to their needs and goals–from exercise to meditation, reading to creativity.

- Creating a personalized morning routine starts with tracking our time, identifying what matters most to us, and making time for those activities.

Charlie’s Favorite Section of the Book

My favorite section of the book What the Most Successful People Do Before Breakfast was definitely the part where she interviews successful people about their morning routines.

It was fascinating to see how different individuals from various fields approach their mornings and set themselves up for success.

The personal stories shared by CEOs, athletes, and artists provided valuable insights and inspiration for creating my own morning routine.

I particularly enjoyed reading about the diverse activities they engage in, such as exercise, meditation, reading, planning, and creativity.

It made me realize that there is no one-size-fits-all approach, and it’s all about finding what works best for me to kickstart my day with energy and focus.

Other Reader’s Opinions

One reader gave a clear review emphasizing that this book is not for people who want a hand-holding book, but rather for people who want to hear inspiring stories to get them motivated.

Best Finance Book for Retirement

The Millionaire Next Door

By Thomas J. Stanley

Why This Book Was Chosen

The Millionaire Next Door was chosen for its groundbreaking insights into the habits and mindset of America’s millionaires.

With a focus on innovation and forward-thinking, Thomas J, Stanley challenges conventional wisdom and offers a fresh perspective on achieving financial independence.

By incorporating cutting-edge research and interviews, the authors provide readers with actionable strategies to create lasting wealth and embrace a lifestyle of abundance.

Key Takeaways

- Emphasizes the importance of frugality and avoiding unnecessary expenses, allowing you to invest your money wisely and build wealth over time.

- Millionaires understand the power of investing in appreciating assets, such as stocks and real estate, to grow their wealth and secure their financial future.

- Highlights that most millionaires are self-made individuals who have achieved success through their dedication, perseverance, and relentless work ethic.

Charlie’s Favorite Section of the Book

In my opinion, the most captivating section of The Millionaire Next Door is Chapter 3, titled Time, Energy, and Money.

This chapter delves into the importance of managing these three resources effectively to achieve money desires.

Stanley gives practical tips and real-life examples that highlight the power of discipline and prioritization in building wealth.

Other Reader’s Opinions

One reader claimed that The Millionaire Next Door is a must-read for anyone who wants to manage their money rather than having money manage them.

Another reader says that the book is “highly statistical” and that you can tell who is an American millionaire and who isn’t based on factors such as the car they drive and how they spend their time planning their finances.

Wrapping Up

With over 129,000,000 books published since 1440, choosing a book that aligns with your wants, needs, and values for building wealth is crucial, as it can significantly shape your life’s direction.

This is just one aspect of the journey toward making money, though. Beyond learning from one (or more) of these books, you’ll need to translate that knowledge into action. Anyone can absorb a wealth of information and become exceptionally knowledgeable on a topic, but not everyone can effectively implement what they learn.

That’s why it’s essential to complement the insights gained from these books with the actions you intend to take, ensuring you extract the full value from your wealth-building aspirations.

Leave a Reply